Please update your browser.

税收是生活中为数不多的确定性之一. Previous tax seasons often serve as a reliable guide for families in predicting their likely refunds or payments each year, 家庭也会相应地调整他们的储蓄和支出. But for many families, the 2019 tax season created uncertainty due to the effect of changes enacted by the Tax Cuts and Jobs Act. 根据美国国税局的数据,有15分.2019年是税法修订后的第一个纳税季,退税总额减少了8%. 2018年,平均退款为2135美元,而2019年为1949美元,涨幅为23%.2% decrease1. 这种变化大部分归功于新法律, 哪些对税收等级做出了重大改变, standard deductions, 还有为有孩子的家庭提供信贷. Tax specialists indicate that the lower tax refunds in 2019 were due to families receiving higher paychecks throughout the year, 退款少,有时甚至少交税款, 根据总会计办公室2.

纳税时间构成了一项重大的年度财政事件, 是什么决定了一个家庭全年的消费和储蓄模式. The JPMorgan Chase Institute has examined the tax time event in the context of families’ finances, including the impact of tax payments or refunds and the connection between receiving a refund and out-of-pocket healthcare spending. In our report Weathering Volatility 2.第0集:指导储蓄的月度压力测试, we found that on average, 家庭在一年中的近五个月里经历了巨大的收入波动, namely February, March, April, and December. 今年年初的飙升很可能是由于退税.

图1:收入飙升、下降和典型月份的说明性例子.

In 纳税时间:家庭如何管理退税和支付, 我们研究了2015年至2017年纳税时间对家庭的影响, 在《澳博体育app》生效之前. During the years studied, families who made tax payments, just 8 percent of our sample, 通常他们的支票账户里有足够的资金来支付这些费用. 对于几乎所有付款的家庭, 这笔付款对它们的流动或余额没有持久的影响. These families did not cut expenditures or increase their labor income to cover the payment. Instead, they transferred cash into their checking accounts during the three weeks leading up to the payment. This is true even for families who didn’t appear to have enough cash to cover their payments just a few weeks before making them.

绝大多数美国家庭都是这样.S. 收到退税,我们78%的样本. For 29 percent of these families, the day the tax refund arrived was the day of the year with the highest positive cash flow, an average refund of $3,602, 或者相当于6周的实得工资. The day the tax refund arrives, 美国家庭的支出比一般家庭高出约180美元, a 119 percent increase. 他们还拨出了一大笔积蓄. 收到退款后六个月, 普通家庭的支出水平已经稳定到一个新的稳定状态, 几乎比退款前的稳定状态高7%. Even still families’ checking account balances were 11 percent higher than baseline six months after the tax refund.

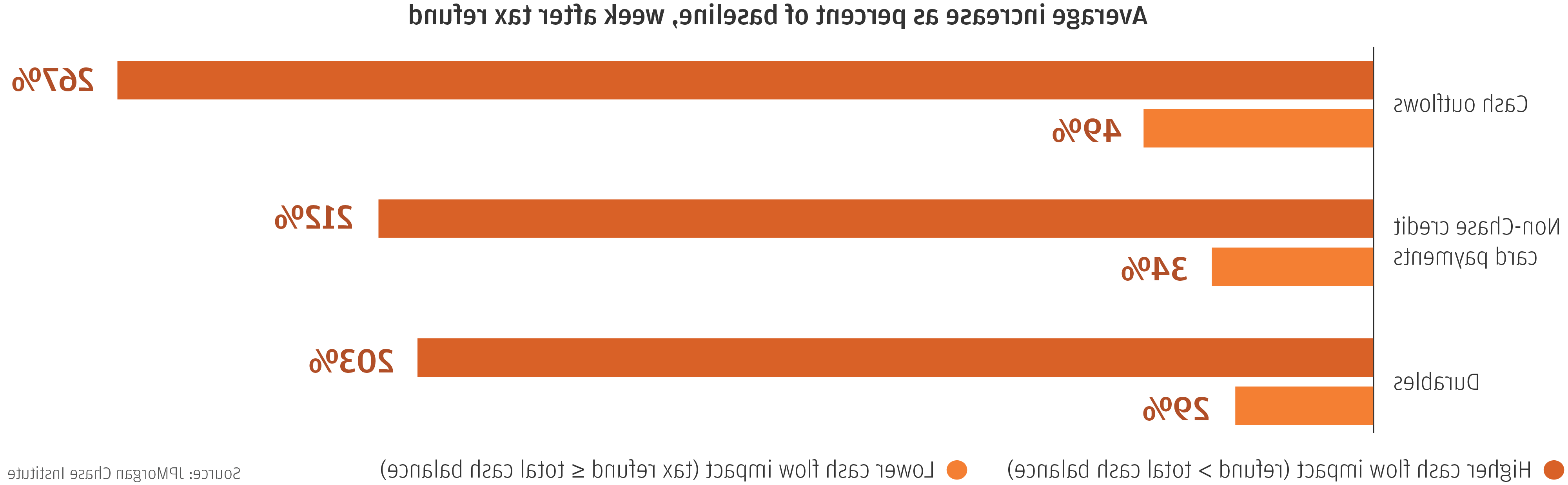

考虑到退税到时支出会大幅增加, 我们研究了人们把退税花在了什么地方. We find that families put off spending and accrue credit card debt while they wait for their tax refund to arrive. On average, about one fifth of the expenditure response within the first week of the tax refund represents families paying down bills – mostly bills from past consumption, 包括信用卡和医疗账单. Thus, some of the tax refund, 什么是向政府偿还免息贷款, 是用来偿还有息信用卡债务的吗. Spending on durable goods doubles in the week after receipt of a refund from $25 during a typical week to $50 post-refund. 家庭提取的现金也增加了一倍以上, 比平时多提取了200美元现金. Lower income families and those with lower cash balances are especially likely to time durable goods spending around their tax refund, 在他们收到贷款之前,还要背负更高的信用卡循环债务.

图2:耐用品支出, credit card payments, and cash withdrawals increase most sharply upon receipt of a tax refund—and families for whom the refund has a larger cash-flow impact increase their spending and saving more sharply upon receipt.

For many families, 退税持续时间远远超过纳税季节, 刺激了半年多的消费和储蓄. This raises questions about whether families have the cash management tools and information they need to integrate their tax refunds into financial planning.

We also find that tax refunds are a significant driver of out-of-pocket spending for healthcare in our report 递延医疗:退税如何促进医疗支出. The overall level of healthcare spending is 60 percent higher in the week after receiving a tax refund than in a typical week over the 100 days before. 在收到退税后的一周内, 借记卡支付的医疗费用增加了83%, 电子支付增长了56%. 信用卡消费没有相应的变化, suggesting that the liquidity provided by the tax refund drove the change in spending behavior.

图3:收到退税付款时,自付医疗保健支出激增

We find that cash flow dynamics drive not only when families pay for healthcare but also when they actually receive healthcare. Sixty-two percent of the increase in out of pocket healthcare spending in the week after the tax refund represented in-person payments for healthcare services. It is likely that payments made at the point of service are made at the time that the service is provided. In that case, the additional dollars spent in person would identify deferred care—healthcare services that consumers would have received earlier, 如果他们的退款付款来得早.

专家们认为,如果消费者在医疗保健方面有更多的选择, they would be able to make more cost-effective choices; however, 我们的研究强调了现金流在医疗保健消费中的重要作用. 现金流限制可能会在短期内阻止寻求高成本的护理, even if it would be better for the patient and the healthcare system overall in the long run.

How families manage household income and spending volatility and financial uncertainty is a key research area for the JPMorgan Chase Institute and an increasingly important area of innovation and policy discussion. 现在,随着《澳博体育app》的通过,我们进入了第二个纳税季节, did families retain the same withholdings so they can receive higher paychecks and lower refunds, 或者改变预扣税以最大化纳税回报? How did families manage their spending, saving, and healthcare in the new tax environment? 我们期待着在这一领域继续进行研究和分析, as we seek to apply our granular data lens in order to provide a unique perspective on household income and spending.